How to conduct a business cost savings audit (with checklist)

When the future feels uncertain, what do companies do?

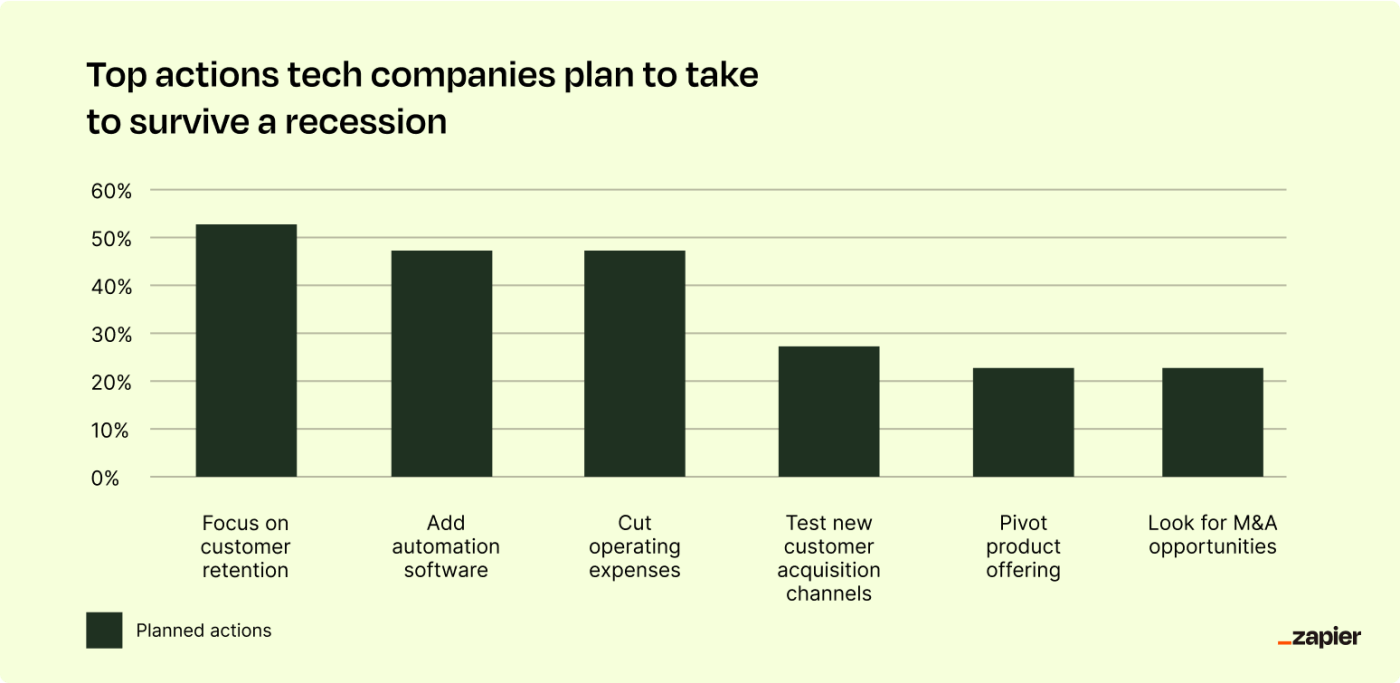

Zapier surveyed over 500 technology founders, executives, and employees at tech companies to learn how they might prepare for a recession—and 47% of companies said they would cut operating costs.

Knowing what costs to cut is a conundrum, though. If you drop tactics or tools that aren't pulling their fair share, you can become leaner and more successful. But if you pull the plug on something important, you risk harming your company in an already vulnerable time.

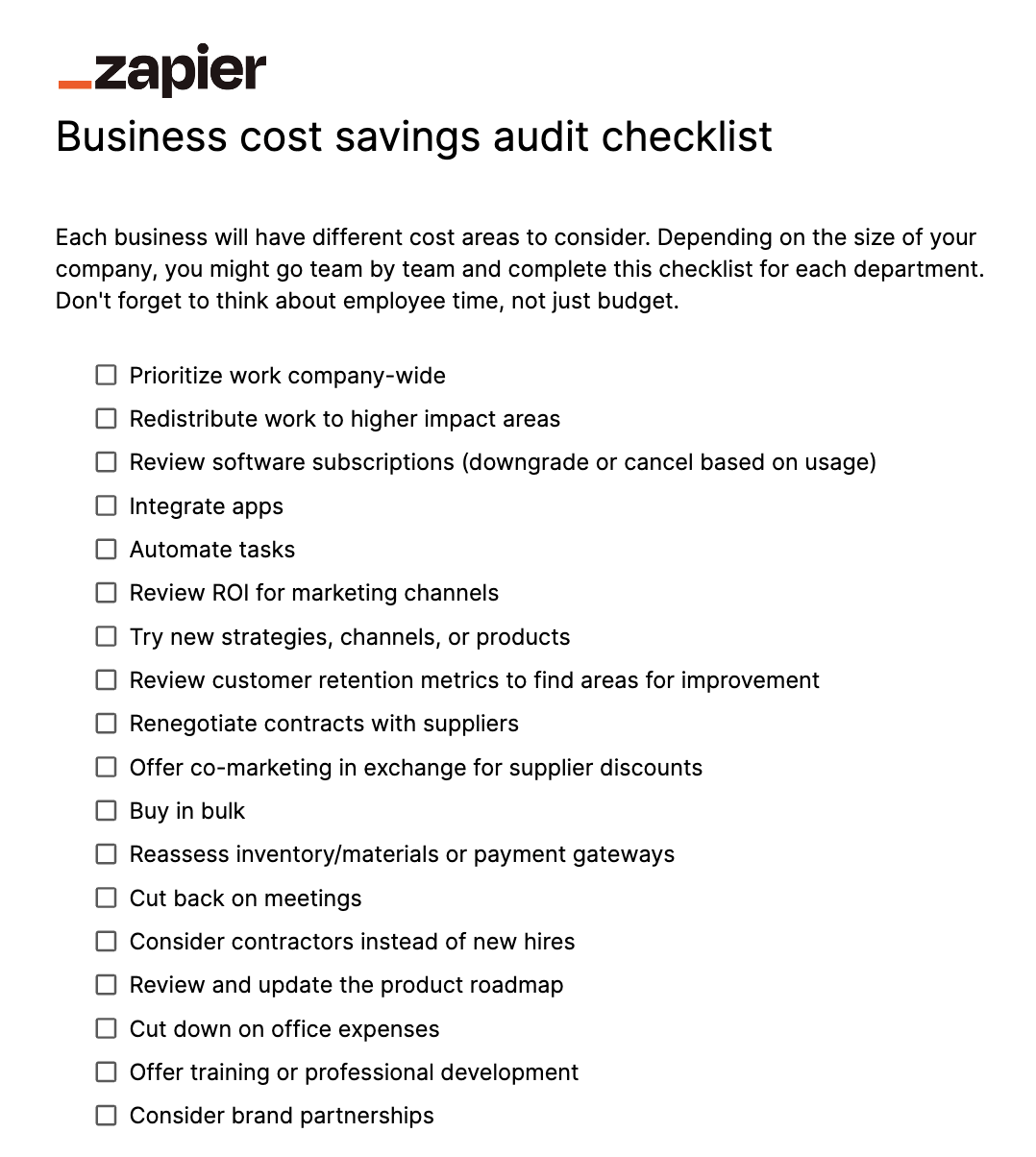

The best way to find areas to save money is by conducting a business cost savings audit. This guide explains how to assess your company and make the right budget choices—and I've put together a cost savings checklist to help.

How to find business cost savings opportunities

Take your pointer off of the "cancel subscription" button and step away from the light switch. Whatever motivates you to look for business savings opportunities, you'll have better luck with a thoughtful plan.

Assess every part of your business

You can take a measured approach to find ways to cut back business costs. Here's how:

1. List every expense in your business—both monetary and time. You'll probably want to break this task down into manageable bits (like the areas we'll review below).

2. Measure the impact of everything. Use metrics like return on investment (ROI) to consider each tool, strategy, and department. Does the payoff of that expense make up for the cost? How has the price and value changed over time? Does it contribute to or diminish the employee and customer experience?

3. Decide if you want to keep or leave an expense. If something is a business driver, keep doing it. If it's a cost center, look for ways to save and improve.

Look for ways to optimize cost centers

As you go through each of these steps for the cost-saving areas we'll review in a moment, remember that there are more ways to save money than just cutting costs. If something isn't living up to its full potential, there are multiple ways you can fix it.

- Cut costs. Finding tactics or tools that cost more than they're worth is a great way to stay lean. Bonus: regularly reviewing encourages you to consistently improve.

- Buy in bulk or rework agreements. You can save money on items or services you still need by renegotiating contracts or opting into longer-term commitments. It's just like Costco or any other bulk discount store—it'll cost more upfront, but the per-unit savings are there. If you're going to buy something anyway, you may be able to save money in the long run.

- Save time with automation. Time is money, and automation saves time. You can work more efficiently to spend time on revenue-driving activities and cut out repetitive work. 47% of companies plan to use automation software to save money during a recession.

- Redistribute or reprioritize. Redistribute work to match strengths, and ensure everything you work on is for a clear and relevant end goal. In short, do more of what works and less of what doesn't.

Business cost savings ideas: Areas to review for your audit

Reviewing every single thing can be daunting. I've broken it down into a series of areas that apply to most businesses, so you can work on your audit little by little. Use this business cost savings checklist to be sure you've covered every area, and keep reading for details on the questions you should be asking.

Products and services

Every business has products they sell, services they use, or both. Here are some questions to ask yourself to find savings opportunities:

- Can you renegotiate with suppliers for longer or larger commitments at lower costs?

- Can you set up a co-marketing campaign or collaboration with a service you use in exchange for a discount?

- Are you keeping more inventory than needed? Would an inventory management tool help you procure more efficiently?

- If you use a payment gateway, is it the most cost-effective one for your business?

- Are you fully using your subscription services? If not, can you drop to a lower-priced plan?

- Do you need every app in your tech stack? Or can some do double duty?

Solidstudio, a software development company, had to get creative to make the most of its marketing budget and tool stack. They knew they needed a customer relationship management (CRM) system but weren't ready to pay for an advanced HubSpot account. Instead, they used a free version of HubSpot to manage leads and customers, paired with a HubSpot and Zapier integration to automate lead nurturing. Ultimately, their creative use of Zapier saved them more than $6,000 in software costs.

Employees

Your employees are the driving force and public face of your company. When you treat them well, they can take care of your customers, which boosts your bottom line. A Glassdoor survey found that each one star improvement in a company's Glassdoor rating by employees correlated to a 1.3% improvement in customer satisfaction scores.

There are ways to empower your team to make the most of the resources available. Ask yourself these questions before you jump to budget cuts or layoffs:

- Can you invest in employee training and professional development to help someone grow within a role without hiring additional support?

- Is anyone spending time on repetitive tasks that you could automate?

- Are all meetings productive and required? If not, can you incorporate asynchronous communication, so teams spend more time on deep work?

- Are you empowering each person to complete tasks that play into their strengths? If not, consider reworking responsibilities for a happier and more effective team.

- Talk to your employees about where they need additional support. Do you need to hire a full-time employee, or could a contractor or part-time employee help distribute the workload?

Marketing and sales

Marketing and sales are profit drivers, but they're also two areas where you can get stuck in the status quo of a tactic or channel that isn't worth the effort. Here's how to find ways to save money and increase ROI:

- What marketing channels have the highest ROI? Brainstorm ways to improve their effectiveness or cut underperforming strategies.

- What marketing channels meet company goals? Redistribute effort to spend more time there.

- What are the most time-intensive marketing tactics? Can you automate the processes?

While most cost-saving ideas focus on removing or reworking strategies, you can also strengthen your business by adding. According to the Zapier survey mentioned earlier, nearly 30% of respondents said they would test new customer acquisition channels in case of a recession. Trying a new approach could open you up to new audiences.

Read more: How SMBs can run ad campaigns like the Fortune 500

Development

Product, app, and web development bridge the gap between ideas and reality. Since development projects can take a significant amount of time, use these questions to look for cost savings:

- Do development tasks align with your product roadmap and priorities? Suppose engineering teams spend time creating or updating features that never see the light of day or don't move the business forward. In that case, it may be time to reassess.

- What part of the development process frustrates your team the most? How can you automate, improve communication, or manage workloads?

While it's a bit extreme, you might even consider pivoting your product offering in order to weather a recession—a little over 20% of companies said that's what they'd do.

Operations

Many factors contribute to your company's operations costs. For example, do you have a retail store, or are you a fully-remote company? Is your company based in a rural or metro area? Do you have specialized equipment? Here are a few questions to get you started on your operations cost audit:

- If you have a physical store or office, how impactful is it to the success of the business? If it's essential, keep it as it is. If not, consider downsizing or going remote.

- Do you use your internet and phone plans to their full extent? Can you negotiate the rate or plan

- Can you save on energy costs?

- Are you being as lean as possible with your employees' devices and accounts? Are there any IT inefficiencies?

Customer retention

The most popular way companies plan to survive a recession has nothing to do with costs and everything to do with customers. 52% of companies will focus on customer retention during a recession, making the most of every dollar spent on acquisition.

To assess your customer retention efforts, look at your churn rate, customer retention rate, repeat order rate, average order value, and customer lifetime value. What can you do to improve those?

Customer experience, also called CX, considers every touchpoint a customer has with your brand. Creating a customer-centric experience across the customer journey isn't only a nice thing to do for the humans you're selling—it's also good for business. HelpCrunch prioritized customer experience from the start, and they now have a 95% customer satisfaction rating and a 4% churn rate.

Read more: 4 ways to automate customer retention

Partnerships

Brand partnerships are great during good times—and they're even better during hard times. Think about how you might work with other folks in your (or an adjacent) industry to share costs or share customers. To start, read about how brand partnerships can be a growth strategy. Then ask yourself:

- What kinds of co-marketing could you do with complementary brands also looking to cut costs?

- Do you have a lead magnet that you could share with another company that would benefit their customers as well?

A more extreme version of this would be a merger or acquisition. Around 20% of companies who responded to the Zapier survey said they'd look for merger and acquisition (M&A) opportunities during a recession.

Plans make difficult situations easier to handle

Chances are, if you're looking for ways to save money in your business, there's a specific cause. Whether it's the state of your business or the direction you feel the economy or your industry is going, it's likely an overwhelming and emotional time. That's all the more reason to take a measured approach. Take a deep breath, review each area one by one, and stay creative. You've got this!

This article, written by Steph Knapp, appeared first on Zapier.